Bedrooms: 0

Bathrooms: 0

About this Land

in Moss Park, Toronto

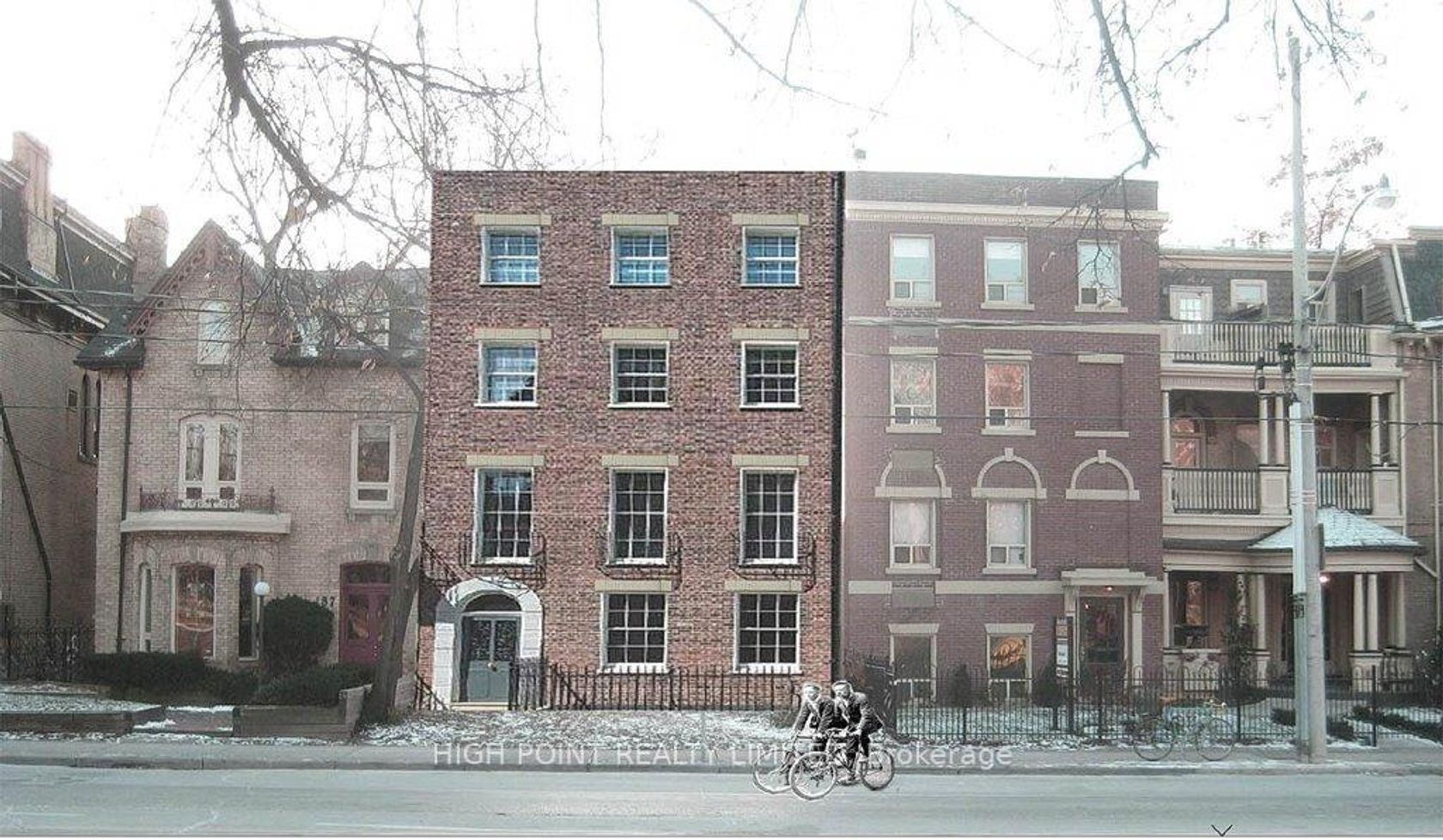

This is a rare, shovel-ready vacant lot located at 185 Gerrard Street East in the heart of downtown Toronto, fully zoned (RM) and approved for a 4-storey residential development featuring 28 self-contained microunits. All architectural drawings, site plans, and permits are in place, allowing for immediate construction. Ideally positioned just steps from Toronto Metropolitan University (TMU), George Brown College, major hospitals like St. Michaels and SickKids, and within walking distance to the Financial District, this property is perfectly suited for student housing, hospital staff residences, or young professionals seeking affordable, efficient urban living. Each unit is thoughtfully designed with modern layouts to meet the high demand for compact residential spaces. With exceptional walk, transit, and bike scores, and close proximity to public transit, parks, and daily amenities, this development offers significant rental upside and long-term value. Whether you're a developer looking to build and hold, an investor seeking strong rental returns, or a joint venture partner looking to collaborate on a turn-key downtown project, this site presents an outstanding opportunity in one of Torontos most supply-constrained and growth-oriented neighborhoods.

Listed by HIGH POINT REALTY LIMITED.

Photo 0

Photo 1

LAND TRANSFER TAX CALCULATOR

| Purchase Price | |

| First-Time Home Buyer |

|

| Ontario Land Transfer Tax | |

| Toronto Land Transfer Tax | |

Province of Ontario (effective January 1, 2017)

For Single Family or Two Family Homes

- Up to and including $55,000.00 -> 0.5%

- $55,000.01 to $250,000.00 -> 1%

- $250,000.01 to $400,000 -> 1.5%

- $400,000.01 & $2,000,000.00 -> 2%

- Over $2,000,000.00 -> 2.5%

First-time homebuyers may be eligible for a refund of up to $4,000.

Source: Calculating Ontario Land Transfer Tax

Source: Ontario Land Transfer Tax for First-Time Homebuyers

City of Toronto (effective March 1, 2017)

For Single Family or Two Family Homes

- Up to and including $55,000.00 -> 0.5%

- $55,000.01 to $250,000.00 -> 1%

- $250,000.01 to $400,000 -> 1.5%

- $400,000.01 & $2,000,000.00 -> 2%

- Over $2,000,000.00 -> 2.5%

First-time homebuyers may be eligible for a rebate of up to $4,475.

Source: Municipal Land Transfer Tax Rates and Calculations

Source: Municipal Land Transfer Tax Rates Rebate Opportunities

MORTGAGE CALCULATOR

| Asking Price: | Interest Rate (%): | ||

| Amortization: | |||

| Percent Down: | |||

| Down Payment: | |||

| First Mortgage: | |||

| CMHC Prem.: | |||

| Total Financing: | |||

| Monthly P&I: | |||

| * This material is for informational purposes only. | |||

Request A Showing Or Find Out More

Have a question or interested in this property? Send us a message!

inquire