Bedrooms: 1

Bathrooms: 1

About this Condo

in Waterfront Communities C1, Toronto

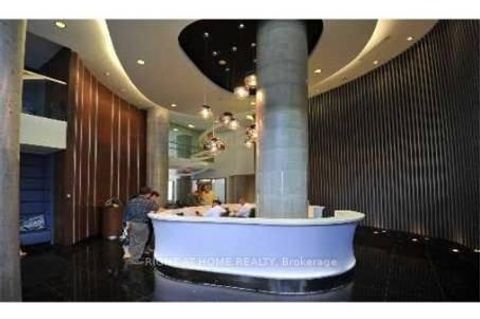

Newly Painted Through Out, New Vinyl Flooring, New Custom Window Sheers, One Bedroom Unit, located above lobby hallway, 9ft ceiling with Modern Kitchen, close to Waterfront-Queens Quay & Lakeshore, Gardiner & TTC at doorstep. Easy walk to the 8 acre Park, school, Loblaws, Banks & Canoe Landing Community Centre, Floor to Ceiling Windows for maximum natural light, Roof Top Garden with BBQ & Hot Tub. Very comfortable party rooms with wet bar area, Gym room with rock climbing, 24hr concierge and guest room. Surrounded by lots of entertainment venues, Restaurants, CN Tower, Rogers Centre & Scotiabank Arena Events Centre. There's never short of something to see or do in this vibrant location.

Listed by RIGHT AT HOME REALTY.

Photo 0

Photo 1

Photo 2

Photo 3

Photo 4

Photo 5

Photo 6

LAND TRANSFER TAX CALCULATOR

| Purchase Price | |

| First-Time Home Buyer |

|

| Ontario Land Transfer Tax | |

| Toronto Land Transfer Tax | |

Province of Ontario (effective January 1, 2017)

For Single Family or Two Family Homes

- Up to and including $55,000.00 -> 0.5%

- $55,000.01 to $250,000.00 -> 1%

- $250,000.01 to $400,000 -> 1.5%

- $400,000.01 & $2,000,000.00 -> 2%

- Over $2,000,000.00 -> 2.5%

First-time homebuyers may be eligible for a refund of up to $4,000.

Source: Calculating Ontario Land Transfer Tax

Source: Ontario Land Transfer Tax for First-Time Homebuyers

City of Toronto (effective March 1, 2017)

For Single Family or Two Family Homes

- Up to and including $55,000.00 -> 0.5%

- $55,000.01 to $250,000.00 -> 1%

- $250,000.01 to $400,000 -> 1.5%

- $400,000.01 & $2,000,000.00 -> 2%

- Over $2,000,000.00 -> 2.5%

First-time homebuyers may be eligible for a rebate of up to $4,475.

Source: Municipal Land Transfer Tax Rates and Calculations

Source: Municipal Land Transfer Tax Rates Rebate Opportunities

MORTGAGE CALCULATOR

| Asking Price: | Interest Rate (%): | ||

| Amortization: | |||

| Percent Down: | |||

| Down Payment: | |||

| First Mortgage: | |||

| CMHC Prem.: | |||

| Total Financing: | |||

| Monthly P&I: | |||

| * This material is for informational purposes only. | |||

Request A Showing Or Find Out More

Have a question or interested in this property? Send us a message!

inquire