A great update from our good friend Sean Humphries Mortgage Agent

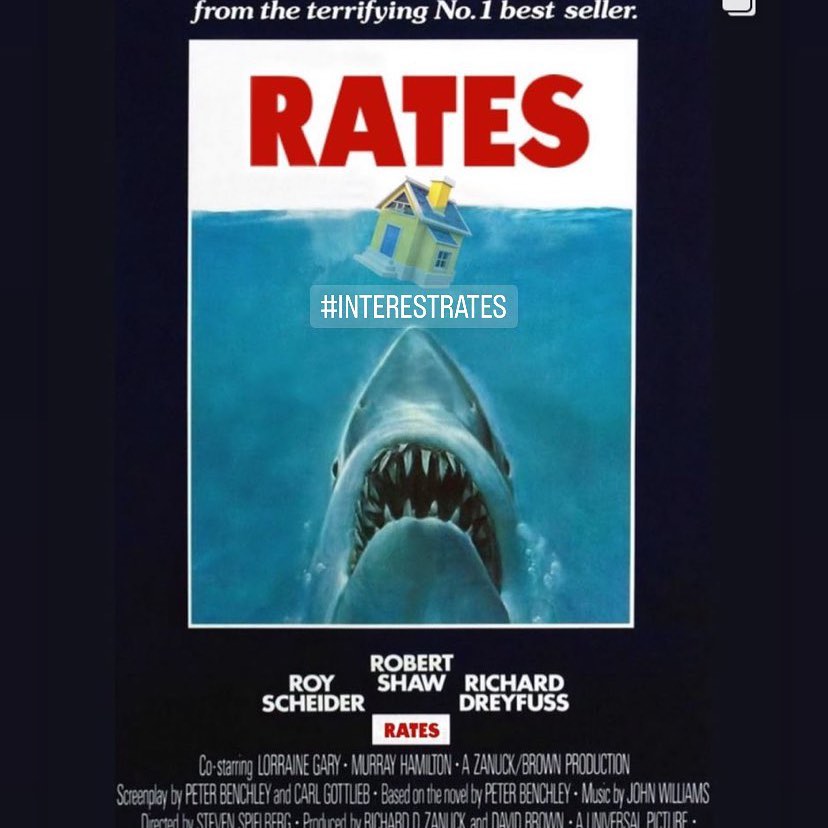

“After today’s Bank of Canada meeting, your JAW might be on the floor. With yet another Prime Rate increase, the cost of borrowing just went up again… by a whopping 100 basis points! This is the biggest rate hike since August 1998.

The increasing expense of mortgages has the media reporting the fearful idea that Canadians will either sink or swim, potentially losing their homes in the waters of rising interest.

DON’T PANIC!

What goes up, must come down. Until then, the best thing you can do to address your home financing concerns is speak to a professional that’s what we’re here for. With 3 more BoC

meetings remaining in 2022, don’t hesitate to reach out to me via DM – I’m always happy to provide my expert opinion. (Sean Humphries Mortgage Agent)

The Bank meets again on:

@ September 7th, October 26th & December 7th”

Send me DM if you have any questions or need help understanding how this will impact you.